متعلقہ مضامین

-

Russia and Pakistan key stakeholders in Afghan peace: envoy

-

Govt introduces one window option to register new companies online

-

Zardari disqualification petition: political fights should be fought in parliament: IHC

-

Asia Bibi free to travel anywhere: FO

-

Sahiwal victims’ family refuses to take part in identification parade

-

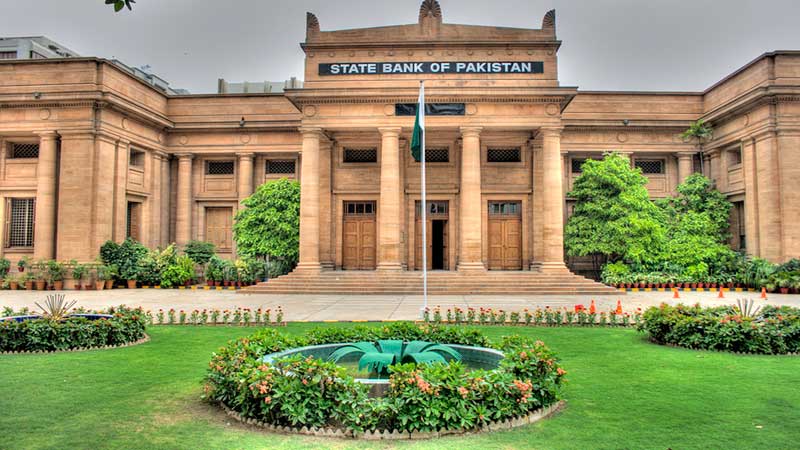

Talpur, Majeed file review pleas in fake bank accounts case

-

Govt in attempt to bring 5G technology in Pakistan, Minister for IT

-

New visa regime shows how progressive Pakistan is: Chinese ambassador

-

By empowering smaller provinces, people’s problems will be resolved faster: NA speaker

-

PM directs FBR to focus on big tax evaders, non-filers

-

By empowering smaller provinces, people’s problems will be resolved faster: NA speaker

-

NAB chairman terms bureaucracy backbone of country